Learn The Truth

What Banks Don’t Want You to Know About Credit Card Processing

Learn the truth about interchange vs. tiered pricing — and see what you’re really paying.

Tiered pricing looks simple — but hides inflated markups.

Many providers lock merchants into fixed, non-negotiable rates.

Interchange pass-through = true wholesale rates + a small flat markup.

Positioning: Businesses processing $100K+ per month should always be on interchange

pass-through.

See your savings

Check The Rates

Interchange Rate Library

Updated quarterly from our data source.

Real Results from Real Businesses

Healthcare

Healthcare providers save avg. $800/mo with interchange pass-through.

Boutique retailers reduced costs by 30%.

Retail

Food & Service

Restaurant groups upgraded terminals at no cost with lower fees.

Note: Savings based on businesses processing $100K+/month. Actual results vary.

What is Interchange Pass-Through Pricing?

Most business owners know they’re paying credit card processing fees—but few actually understand where that money goes. That’s by design. Payment processors often hide behind confusing pricing models that blur the true costs.

Interchange Pass-Through (also called Cost-Plus pricing) is the most transparent way to pay for credit card processing.

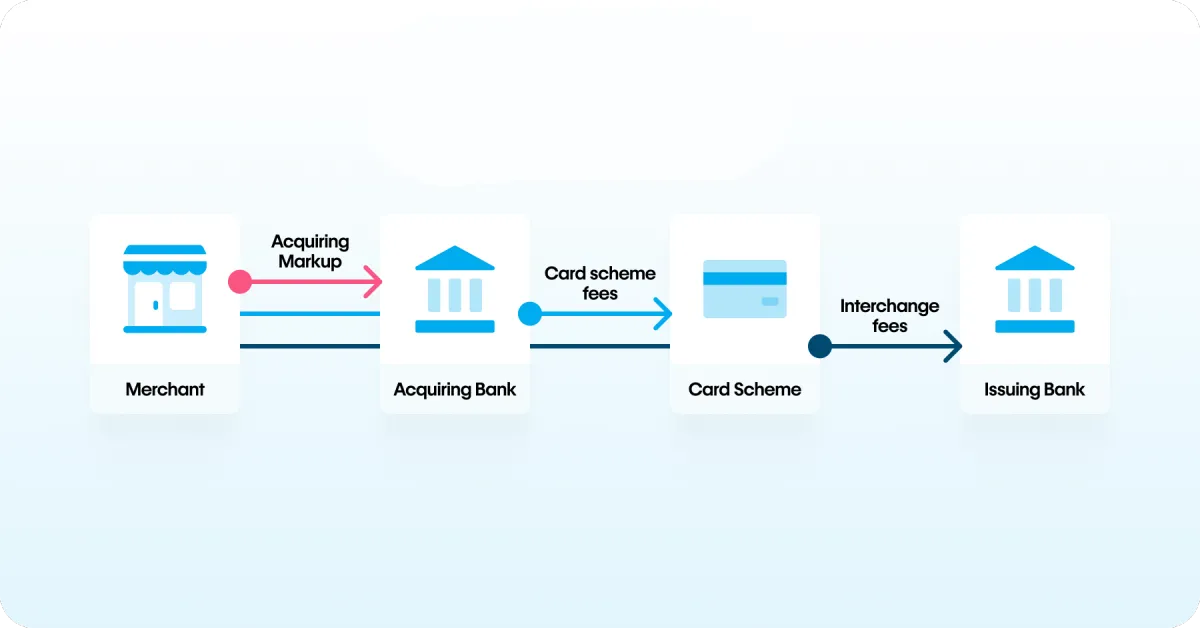

Section 1: How Credit Cards Work

Interchange

The baseline fees set by Visa, Mastercard, Discover, and Amex.

Assessments

Additional small fees from the card networks.

Processor Markup

What your processor actually charges to run your business.

Section 2: Why Pass-Through Matters

With interchange pass-through, you pay the true interchange and assessment costs, plus a clearly defined markup. Nothing is hidden, nothing is bundled.

Key Benefits

🔎 Transparency – See exactly what you’re paying.

📊 Fair Pricing – Keep interchange at cost, only pay a small markup.

🧾 Audit-Friendly – Easier to spot errors or hidden fees.

⚡ Scalable – Works better as your business grows.

PRICING MODELS

Not all models are created equal — one gives you the edge.

Flat Rate

One rate for all transactions (e.g., 2.9% + $0.30)

Simple, predictable

Often overpays on debit & regulated cards

Tiered

Transactions bucketed into “qualified,” “mid,” and “non-qualified”

Marketed as “savings”

Opaque, prone to hidden fees

Interchange Pass-Through

True interchange + assessment + markup

Transparent, fair, scalable

Requires education to understand

Exposing Hidden Fees

Processors bury charges in complex statements so you can’t easily spot markups or hidden fees.

🧾 Statement Fees – Paying just to see what you owe.

🔒 PCI Compliance Penalties – “Penalties” for vague requirements.

⚙️ Batch Fees – Charged every time you settle transactions.

🚫 Non-qualified Surcharges – Extra charges for certain card types.

🏷️ “Club” or Membership Add-ons – Disguised markups.

If your statement looks confusing, it’s not by accident. Transparency favors you, not the processor.

Upload your statement for a free review

CONTACT 1stFMG!

GET IN TOUCH

Merchant services, interchange-plus/pass-through pricing, terminals, and 24/7 support. Contact 1st FMG today!

Phone: (866) 368-6394

Email: [email protected]

Visit: 21224 Vanowen Street, Los Angeles, CA 91303

Enter our mailing list!

Mailing list not available yet.